Non-Homestead Millage Frequently asked Questions

FREQUENTLY ASKED QUESTIONS

What is a non-homestead millage?

Non-homestead property includes all taxable property within the District with the exception of a family’s

primary residence, most agricultural, certain forestry property, and certain industrial and commercial

personal property. Non-homestead property includes industrial, commercial and some agricultural real

estate and ‘second homes.’ A non-homestead millage refers to the rate at which non-homestead

properties are taxed.

Why do districts levy 18 mills on non-homestead properties?

Each district in the State of Michigan uses the per pupil funding allotment to plan its annual budget. The

State determines the per-pupil amounts during their annual budget process.

In determining the State aid funding, the State assumes each district is collecting 18 mills from its non-

homestead properties. The State then backs out the non-homestead property taxes (the full 18 mills)

before sending the district its monthly payments. With the full 18 Mills, Central Montcalm Public School’s

per pupil allowance for 2023-2024 is $9,608. Without the full 18 mills, the District cannot collect the full

amount per each pupil (student).

The Operating Millage Renewal, if passed, allows the District to restore the full 18 mills through 2029 and

claim the full per-pupil allotment.

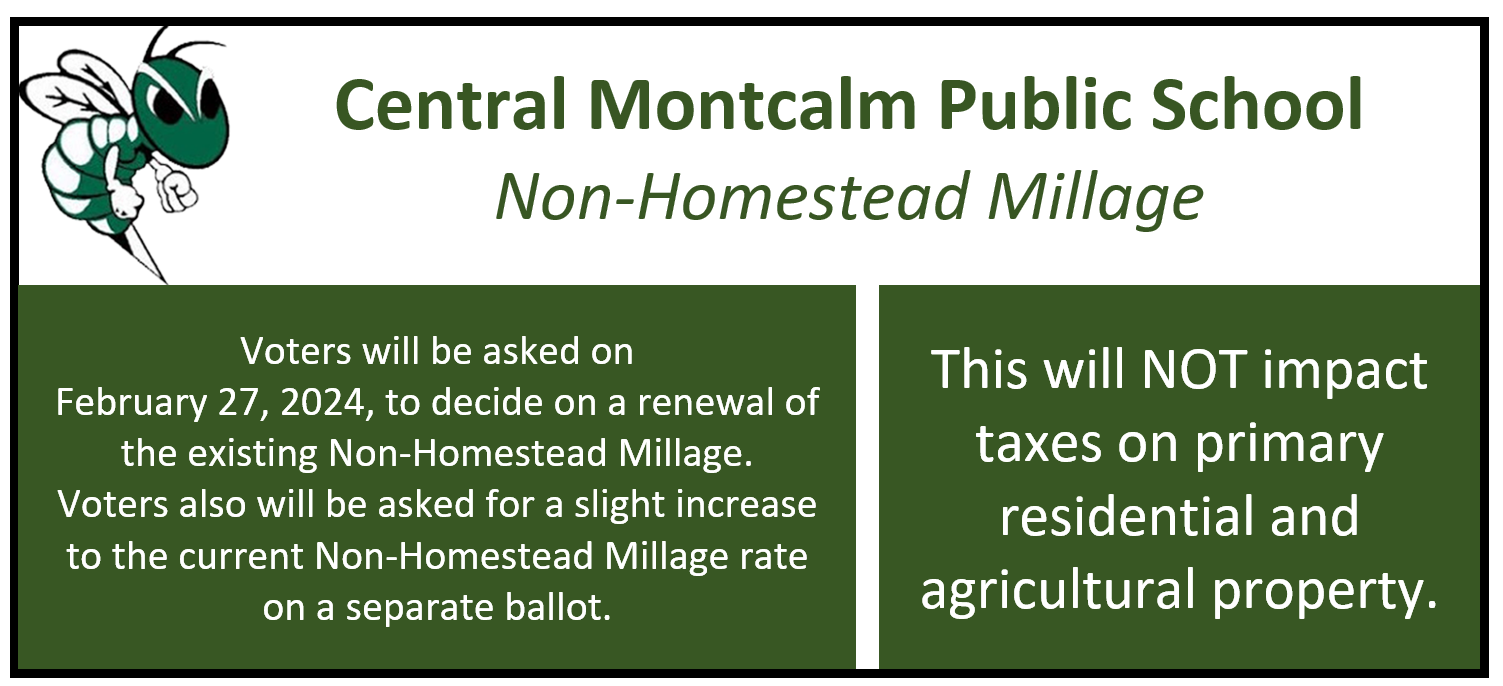

Will my tax rates increase if this proposal passes?

There is no tax increase to homeowners. This millage proposal is only for non-homestead properties, like

commercial, business, rental properties, vacant land, and second-home property owners. The ballot

measure is to restore the full 18 mills that are levied on non-homestead properties.

Didn't we have an election to pass a bond proposal in August of 2023? Is this the same thing?

This non-homestead millage renewal ballot proposal is unrelated to the district’s August 2023 and

possible future bond proposal for an auditorium, improvement of the athletic facility and early childhood

center.

How will the non-homestead millage funds be used?

The funds from the non-homestead Headlee restoration millage go directly into the District's general fund,

which supports day-to-day operations, like programs, curriculum materials, facilities, and employee

salaries.

What happens if the non-homestead millage is not approved?

Based on 2023 non-homestead taxable values, if the District were unable to collect the full 18 Mills

allowed, the district's annual operating revenues would decline by approximately $2,028,395 million,

making it nearly impossible to fund day-to-day operations.