BOND 2024 QUESTIONS AND ANSWERS

What is a bond proposal and how can funds from a bond be spent?

- A bond proposal is how a public school district asks its community for authorization to borrow money to pay for capital expenditures.

- Voter-approved bond funds can be spent on new construction, additions, remodeling, site improvements, athletic facilities, playgrounds, furnishings, equipment, and other capital needs.

- Funds raised through the sale of bonds cannot be used on operational expenses such as employee salaries and benefits, school supplies, and textbooks.

- Bond funds must be kept separate from operating funds and expenditures must be audited by an independent auditing firm.

What are the focus areas of the bond proposal?

- Expanding educational programs and learning environments

- Updating aging buildings & sites

How would the bond proposal impact my property taxes?

If approved by voters, this bond proposal would provide $33,200,000 for district-wide improvements with an estimated no tax rate increase to property owners over the current rate (2023) rate of 7.0 for property owners within Central Montcalm Public School boundary.

What changed from the 2023 bond proposal to the 2024 bond proposal?

We listened and we revised. After the 2023 proposal was not approved by voters, the district conducted a community survey to gather feedback, and had numerous conversations with staff and community members.

We adjusted the proposal:

- Reducing the overall amount of bond proposal by $13.8 million by reducing project scope. The bond total went from $47.5m to $33.2m

- Removing projects that were not our community’s top priorities based on survey results and verbal feedback, including the synthetic turf field

- Removing the early childhood classroom addition from the bond proposal and instead using grant funding to enhance early childhood learning spaces

- Building the auditorium sooner

Why a bond proposal now?

In 2016, voters approved a $11,595,000 bond issue for improvements throughout the district, including a new secure office suite/entrance for the middle-high school, a reconfigured entrance/ticketing entrance to the stadium, parking and traffic flow (pick up/drop off) enhancements at all buildings, select furniture and fixture upgrades throughout the district, and select doors, windows and roofing upgrades in all buildings.

While the 2016 bond took care of some critical issues at that time, there are many infrastructure systems that have since outlived their expected useful lives. This bond proposal would address the remaining, currently identified issues. The district continues to perform preventative maintenance on these systems. Specific systems have exceeded their expected lifecycle(s) – roofing, flooring, etc. If the bond proposal is approved, it would include the replacement of the identified systems and would extend the useful life of our school buildings. This bond proposal also addresses educational programs and learning environments by constructing a new auditorium.

In 2023, a bond proposal for $47,500,000 was not approved by voters. After a period of community feedback and district deliberation, a new proposal with a reduced project scope is now being brought for consideration on the August 6, 2024 ballot.

How are public schools financed in Michigan?

Operational funding

- Funding for the day-to-day operations of the district is provided through state, federal and local sources

- The majority of the funding is allocated through the state per pupil foundation allowance and operating millage

- Programs and services, personnel costs, utilities, supplies and maintenance costs are generally financed in this category

Sinking funds

- Sinking funds have limited allowable uses, including school building construction and repair, school real estate, security improvements, and technology purchases or upgrades

- CMPS does not levy a sinking fund

Bonds

- A bond proposal is how a public school district asks its community for authorization to borrow money to pay for capital expenditures

- With a bond, taxpayers approve an amount of bonds to be issued and taxes are collected in the amount necessary to cover the debt service on bonds

- Funds raised through the sale of bonds cannot be used on operational expenses such as employee salaries and benefits, and school supplies

- Bond funds must be kept separate from operating funds

- CMPS currently levies a 7.0 mill debt tax rate

Why are bond funds needed for improvements to school facilities and infrastructure?

In the State of Michigan, the primary funding mechanism for capital improvements in school districts is requesting taxpayer authorization of bond proposals to permit the district to borrow money to pay for capital expenditures. The bond proposal focuses on addressing aging buildings and enhancing educational programs.

How can we expect to see no tax rate increase while generating $33,200,000?

Each year the bond millage rate is recalculated based upon the school district's new taxable value figure and the bond payment required in the upcoming year. Due to repaying prior outstanding bonds along with taxable value growth, it is estimated that the bond millage rate required to pay the existing bond payments will decline allowing this proposal to be funded without having to change the present bond millage rate of 7.00. (3.96 mills existing bonds + 3.04 mills new bonds + = 7.00 total estimated 2024 millage rate)

Is the bond tax rate expected to be the same for the next 25 years?

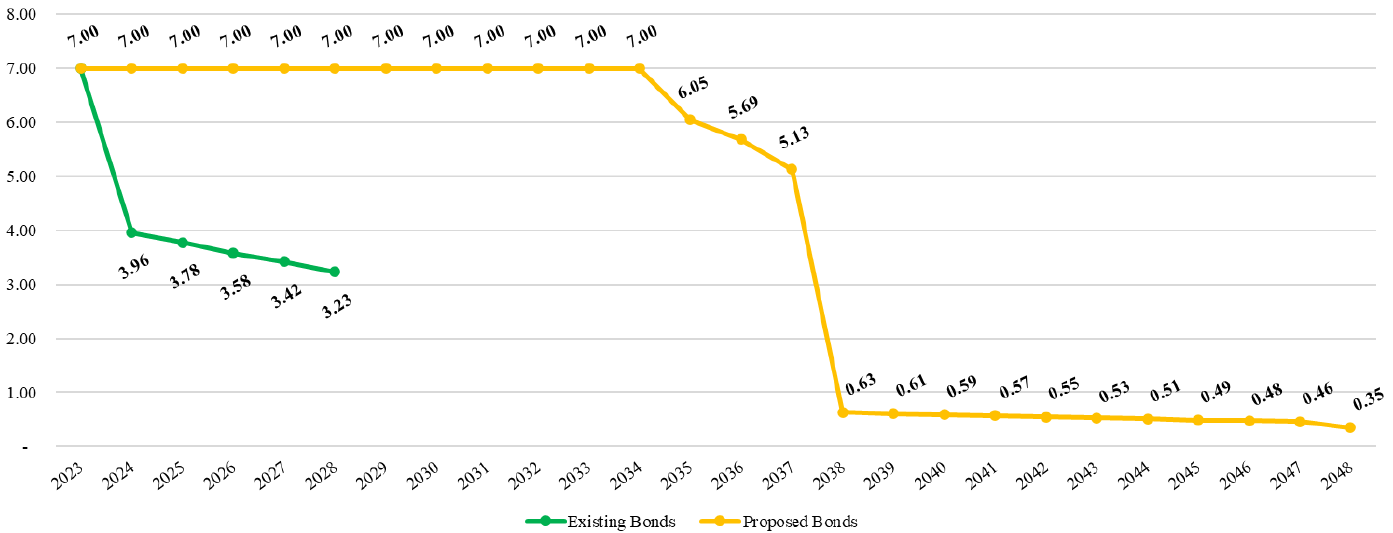

No. The bond tax rate is estimated to remain at 7.0 mills through 2034, and thereafter it is estimated to decline due to bond repayment and taxable value growth, as illustrated in the chart below. If the bond is not approved by voters, the tax rate is estimated to decline to 3.96 mills in Winter 2024.

How would I know the bond funds would be spent the way they are supposed to be spent?

Michigan law requires that expenditure of bond proceeds be audited, and the proceeds cannot be used for repair or maintenance costs, teacher, administrator or employee salaries, or other operating expenses. Michigan law also requires the district have an independent auditor and audits are filed with the State.

How can the school district complete this bond proposal without increasing the bond tax rate of 7.00?

Each year the bond tax rate is recalculated based upon the school district's new taxable value figure and the bond payment required in the upcoming year. Due to repaying prior outstanding bonds along with taxable value growth, it is estimated that the bond tax rate required to pay the existing bond payments will decline allowing this proposal to be funded without having to change the present bond tax rate of 7.00.

How much money would the bond proposal generate and would the funding be issued all at once?

The proposal would generate $33,200,000 which would be spent over multiple years. The bonds are proposed to be issued in 2 separate series (2024, 2026). This would allow for years of bond repayments to occur before more bonds are issued.

Would the approval of the bond proposal have any impact on our current operational budget?

While funding from this bond proposal is independent of the district's general fund operating budget, the bond may have a positive impact on the district’s general fund by allowing the district to reallocate operating funds that are currently being spent on aging facilities, mechanical systems, and technology. The operational savings generated from new and more cost-efficient facilities could be redirected to student programs and resources.

When would the millage for this proposal first be levied if the bond proposal is approved by voters?

On the December 1, 2024, property tax bill.

Are technology purchases going to be amortized over a 25-year period?

No. Most technology purchases are required to be amortized over a 5-year period beginning at the time of installation.

Are businesses and second homes (non-homestead properties) and primary homes (homestead properties) treated the same regarding bond tax rate?

Yes, businesses and second homes (non-homestead properties) and primary homes (homestead properties) are treated the same regarding bond tax rate.

Would money from the bond proposal be used to pay teachers’ salaries and benefits?

No. School districts are not allowed to use funds from a bond for operating expenses such as teacher, administrator or employee salaries, routine maintenance, or operating costs. Bond proceeds must be kept separate from operating funds and expenditures must be audited by an independent auditing firm.

What oversights would hold the district accountable?

If approved by voters, the district’s architect/engineer would design the proposed projects and prepare construction documents and specifications for the projects. Once the projects are designed, the district’s construction manager will assemble bid packages and publicly advertise to solicit competitive bids for all work. This is required by law, as outlined in the Revised School Code. This process ensures that the district selects the lowest responsive and responsible bidder. All qualified contractors will have an opportunity to attend a pre-bid meeting to obtain additional information and project clarification. All qualified contractors will have the opportunity to participate in the competitive bid process.

At what point would the State of Michigan, as well as the local fire and police departments, provide input regarding the bond projects?

Projects would be required to be submitted to both the Bureau of Construction Codes (BCC) and the Bureau of Fire Services (BFS) for both plan review and permitting. These agencies will review the projects to ensure they comply with applicable codes, before any building permits are issued. Building plans and specifications must be signed and sealed by a licensed architect/professional engineer before submission. As of March 21, 2019, Michigan law requires school districts to consult on the plans for the construction or major renovation regarding school safety issues with the law enforcement agency that is the first responder for that school building. This consultation would happen after a bond proposal has been approved by voters, before construction documents are finalized prior to project commencement.

How do I register to vote?

Visit Michigan.gov/vote to register to vote online. It is recommended by the Secretary of State to register by mail by July 22, 2024, to participate in the August 6, 2024, election. Individuals may also register in-person at their local clerk’s office through August 6, 2024, with the required documentation. For assistance in obtaining the address of your local clerk, visit Michigan.gov/vote.

Are owners of property in the school district eligible to vote if they do not reside in the school district?

Owners of property are only eligible to vote if they reside within the Central Montcalm Public School boundaries. To be eligible to register to vote you must be:

- A Michigan resident (at the time you register) and a resident of your city or township for at least 30 days (when you vote)

- A United States citizen

- At least 18 years of age (when you vote)

- Not currently serving a sentence in jail or prison

If I rent a house or apartment, can I vote?

Yes. You must be a registered voter in the city or township you are living in and live within Central Montcalm Public School boundaries.

How is an absentee voter ballot obtained?

Registered voters must complete and submit the application to receive their absentee voter ballot. To vote by mail, fill out the application and sign it, and then return it to your local clerk. For assistance in obtaining the address of your local clerk, visit Michigan.gov/vote. When filling out the application, if you check the box to be added to the permanent absentee voter list, you will get an application mailed to you before every election.

If you registered to vote after absentee voter ballot applications were mailed, applications may be obtained online at Michigan.gov/vote. Absentee voter ballots are available as early as June 27 through election day, August 6, 2024.

What are the key dates leading up to Tuesday, August 6, 2024, election day?

- Attend a public information bond open house:

- May 29 at 4:00 p.m. - 6:00 p.m. at the middle-high school

- Registering to vote:

- The last day for voters to register by mail is July 22, 2024

- Voters may register in person through August 6, 2024 (election day) with the required documentation

- Absentee Voting:

- Absentee voter ballots are available as early as June 27 until August 6, 2024 (election day)

- Contact your local clerk with questions

- Early Voting:

- Montcalm County will be holding 9 days of early voting at Pandemic Readiness Building, 651 N. State Street, Stanton, MI 48888

- It will be held Saturday, July 27 – August 4. Hours will be 8:30 a.m. - 4:30 p.m., except for Wednesday, July 31st, it will be11:00 a.m. – 7:00 p.m.

Where and when will voting occur?

- Tuesday, August 6, 2024, is election day, but absentee voting can occur leading up to that date.

- All registered voters may cast an absentee voter ballot by mail.

- Voters may also cast a ballot at the polling location established by their city/township. Polls will be open from 7:00 am to 8:00 pm on Tuesday, August 6, 2024.

-

Early Voting:

-

Montcalm County will be holding 9 days of early voting at Pandemic Readiness Building, 651 N. State Street. Stanton, MI 48888

-

It will be held Saturday, July 27 – August 4. Hours will be 8:30 a.m. - 4:30 p.m., except for Wednesday, July 31st, it will be11:00 a.m. – 7:00 p.m.

-

- If you have questions or do not know where you vote, please contact your city/township clerk’s office.

Who do I contact if I have additional questions?

Contact Marty James, Superintendent, at bond@central-montcalm.org or 989-831-2000

Paid for by Central Montcalm Public School, 1480 S Sheridan Rd, Stanton, MI 48888